All Categories

Featured

Table of Contents

Another possibility is if the deceased had an existing life insurance policy policy. In such situations, the assigned beneficiary may receive the life insurance policy profits and use all or a part of it to settle the mortgage, allowing them to remain in the home. mortgage protection center. For people who have a reverse home mortgage, which enables people aged 55 and over to obtain a mortgage based upon their home equity, the funding interest accrues gradually

Throughout the residency in the home, no settlements are required. It is essential for individuals to thoroughly prepare and take into consideration these variables when it concerns mortgages in Canada and their influence on the estate and heirs. Looking for assistance from legal and monetary professionals can help ensure a smooth shift and correct handling of the mortgage after the home owner's passing away.

It is crucial to understand the offered choices to ensure the home loan is effectively dealt with. After the fatality of a home owner, there are numerous alternatives for home mortgage repayment that depend upon various aspects, consisting of the terms of the home loan, the deceased's estate planning, and the desires of the heirs. Here are some typical options:: If numerous successors want to assume the mortgage, they can end up being co-borrowers and continue making the home loan payments.

This alternative can provide a clean resolution to the home loan and disperse the staying funds amongst the heirs.: If the deceased had an existing life insurance policy, the designated beneficiary may obtain the life insurance policy proceeds and utilize them to pay off the mortgage (what is mortgage life and disability insurance). This can enable the recipient to continue to be in the home without the burden of the mortgage

If no one proceeds to make home loan settlements after the homeowner's death, the home mortgage financial institution deserves to foreclose on the home. The effect of repossession can differ depending on the situation. If an heir is called yet does not sell the home or make the mortgage repayments, the mortgage servicer can start a transfer of ownership, and the repossession might severely damage the non-paying heir's credit.In instances where a house owner dies without a will or depend on, the courts will appoint an administrator of the estate, typically a close living family member, to distribute the possessions and liabilities.

Mortgage Life And Disability

Home mortgage defense insurance policy (MPI) is a type of life insurance policy that is specifically made for individuals who wish to see to it their home mortgage is paid if they die or end up being disabled. Sometimes this type of plan is called home mortgage repayment protection insurance. The MPI process is simple. When you die, the insurance coverage profits are paid straight to your mortgage company.

When a financial institution owns the big majority of your home, they are accountable if something occurs to you and you can no more make payments. PMI covers their risk in the event of a foreclosure on your home (definition of mortgage insurance). On the other hand, MPI covers your danger in the occasion you can no more make repayments on your home

MPI is the sort of mortgage security insurance every house owner must have in position for their family. The quantity of MPI you need will differ relying on your distinct situation. Some variables you need to consider when considering MPI are: Your age Your health Your monetary circumstance and resources Various other types of insurance coverage that you have Some people may assume that if they presently possess $200,000 on their home mortgage that they must get a $200,000 MPI plan.

Mpi Car Insurance Calculator

The brief solution isit depends. The inquiries people have about whether or not MPI deserves it or not are the exact same inquiries they have about purchasing various other kinds of insurance as a whole. For many people, a home is our single largest debt. That implies it's mosting likely to be the solitary biggest financial difficulty dealing with making it through relative when a breadwinner passes away.

The combination of tension, sadness and transforming family members characteristics can create also the most effective intentioned people to make costly errors. best unemployment mortgage protection insurance. MPI resolves that problem. The value of the MPI plan is straight tied to the balance of your home mortgage, and insurance policy profits are paid straight to the financial institution to deal with the staying balance

And the biggest and most stressful monetary concern facing the enduring relative is resolved quickly. If you have wellness problems that have or will certainly produce troubles for you being approved for regular life insurance, such as term or entire life, MPI could be a superb option for you. Typically, mortgage defense insurance coverage do not call for medical examinations.

Historically, the quantity of insurance coverage on MPI plans went down as the balance on a home loan was lowered. Today, the coverage on the majority of MPI plans will continue to be at the same level you acquired at first. If your initial home loan was $150,000 and you purchased $150,000 of mortgage defense life insurance policy, your beneficiaries will now obtain $150,000 no issue just how a lot you owe on your home loan.

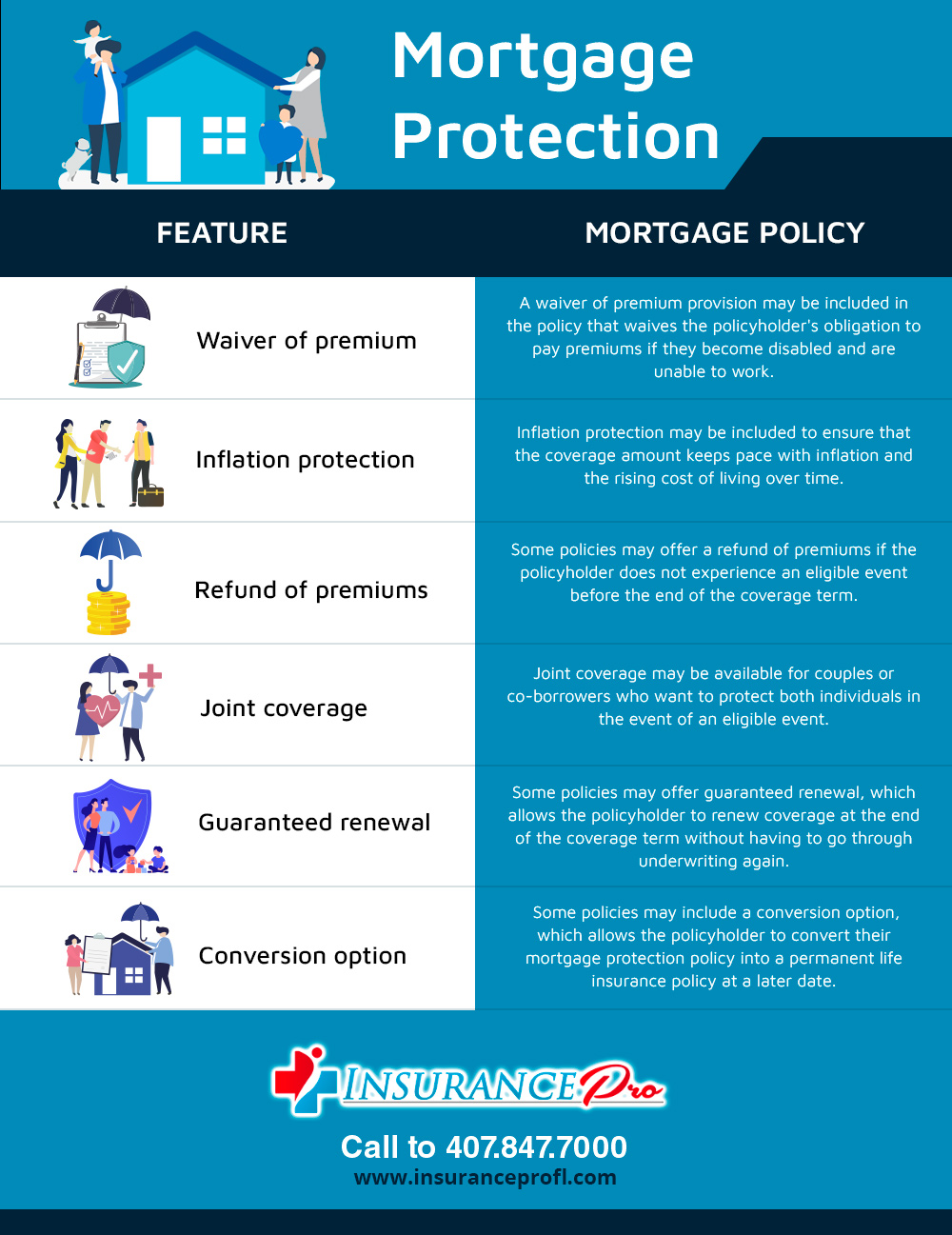

If you intend to settle your home mortgage early, some insurance coverage firms will enable you to convert your MPI plan to one more kind of life insurance policy. This is just one of the inquiries you could desire to address in advance if you are thinking about settling your home early. Prices for mortgage defense insurance will certainly differ based on a variety of things.

Insurance Against Mortgage Loan

An additional element that will affect the costs quantity is if you get an MPI policy that supplies protection for both you and your partner, offering advantages when either among you dies or comes to be impaired. Be aware that some firms may need your plan to be reissued if you re-finance your home, yet that's typically just the instance if you purchased a plan that pays only the balance left on your mortgage.

What it covers is very narrow and plainly specified, depending on the alternatives you choose for your specific policy - dual life mortgage protection. Self-explanatory. If you die, your home mortgage is settled. With today's plans, the worth may exceed what is owed, so you could see an extra payment that could be utilized for any kind of unspecified usage.

For home loan protection insurance policy, these kinds of extra insurance coverage are added on to policies and are understood as living benefit riders. They enable plan holders to touch right into their home mortgage security benefits without passing away.

For instances of, this is typically currently a cost-free living benefit provided by many business, yet each firm defines benefit payouts differently. This covers health problems such as cancer, kidney failing, heart attacks, strokes, brain damages and others. mortgage protection center reviews. Firms typically pay out in a round figure depending on the insured's age and severity of the disease

Unlike a lot of life insurance policy policies, getting MPI does not call for a medical exam a lot of the time. This indicates if you can not get term life insurance coverage due to an ailment, an assured issue home mortgage protection insurance policy can be your finest wager.

Ideally, these must be individuals you understand and depend on who will certainly give you the ideal recommendations for your situation. No matter of who you make a decision to explore a plan with, you need to always search, since you do have options - mortgage insurance job loss. Often, accidental fatality insurance coverage is a far better fit. If you do not get approved for term life insurance coverage, after that unexpected death insurance policy might make more sense due to the fact that it's assurance issue and means you will not undergo medical examinations or underwriting.

Insurance Pay Off Mortgage Case Death

Make certain it covers all expenses related to your mortgage, consisting of rate of interest and settlements. Ask exactly how quickly the policy will be paid out if and when the primary income earner passes away.

Latest Posts

Funeral Insurance Reviews

Funeral Plan Calculator

Burial Insurance Cost For Seniors