All Categories

Featured

Table of Contents

That normally makes them a much more economical alternative forever insurance policy protection. Some term plans might not keep the premium and survivor benefit the same with time. You do not wish to incorrectly believe you're getting level term coverage and after that have your death advantage adjustment later on. Many individuals get life insurance policy coverage to assist economically shield their enjoyed ones in case of their unanticipated fatality.

Or you might have the option to transform your existing term insurance coverage right into a permanent plan that lasts the remainder of your life. Numerous life insurance policy plans have potential advantages and downsides, so it's vital to recognize each prior to you make a decision to buy a policy.

As long as you pay the premium, your beneficiaries will get the death advantage if you pass away while covered. That claimed, it is essential to note that a lot of policies are contestable for 2 years which indicates coverage might be rescinded on death, needs to a misstatement be found in the application. Policies that are not contestable frequently have a graded fatality benefit.

Premiums are generally lower than entire life policies. You're not secured into an agreement for the remainder of your life.

And you can not pay out your plan throughout its term, so you won't receive any kind of monetary gain from your past protection. Similar to various other kinds of life insurance, the expense of a level term plan depends upon your age, insurance coverage demands, work, lifestyle and health and wellness. Normally, you'll find more cost effective protection if you're younger, healthier and much less dangerous to insure.

Guaranteed Term To 100 Life Insurance

Considering that level term premiums stay the same for the period of insurance coverage, you'll understand precisely how much you'll pay each time. That can be a huge aid when budgeting your expenses. Level term insurance coverage likewise has some versatility, enabling you to personalize your policy with additional features. These typically been available in the type of motorcyclists.

You might have to satisfy particular problems and credentials for your insurance firm to establish this motorcyclist. There likewise can be an age or time restriction on the coverage.

The death benefit is usually smaller, and protection typically lasts up until your child transforms 18 or 25. This cyclist may be a much more affordable means to aid ensure your children are covered as cyclists can typically cover multiple dependents at when. As soon as your youngster ages out of this insurance coverage, it may be feasible to transform the cyclist right into a brand-new plan.

The most common kind of long-term life insurance policy is whole life insurance, yet it has some vital differences compared to level term coverage. Right here's a basic overview of what to consider when contrasting term vs.

Honest Does Term Life Insurance Cover Accidental Death

Whole life entire lasts insurance policy life, while term coverage lasts protection a specific period. The premiums for term life insurance policy are generally reduced than entire life insurance coverage.

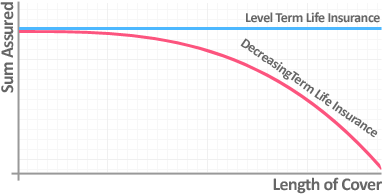

Among the major features of level term coverage is that your costs and your death advantage don't transform. With reducing term life insurance coverage, your costs remain the exact same; nevertheless, the survivor benefit quantity gets smaller gradually. You might have coverage that begins with a fatality advantage of $10,000, which might cover a home mortgage, and then each year, the death advantage will decrease by a collection amount or percent.

As a result of this, it's usually an extra inexpensive type of degree term coverage. You may have life insurance policy via your company, however it may not be sufficient life insurance coverage for your requirements. The primary step when acquiring a plan is identifying just how much life insurance policy you need. Think about aspects such as: Age Household size and ages Employment standing Income Financial debt Way of living Expected final costs A life insurance coverage calculator can assist establish just how much you need to start.

After making a decision on a plan, finish the application. If you're accepted, authorize the documentation and pay your first costs.

Innovative The Combination Of Whole Life And Term Insurance Is Referred To As A Family Income Policy

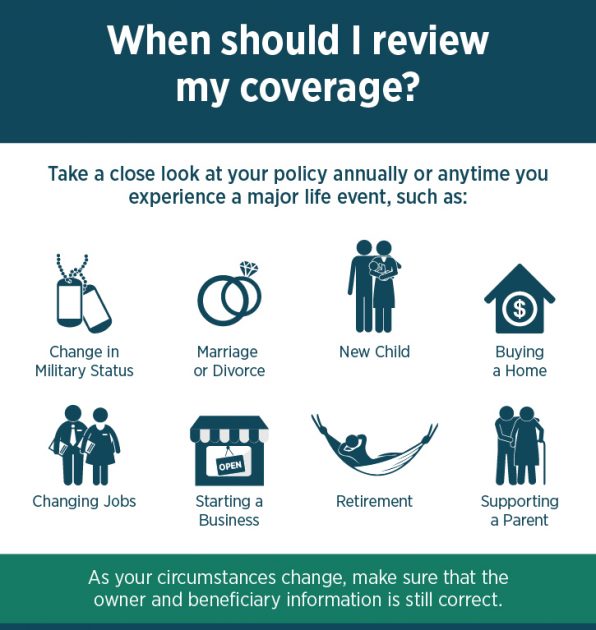

You might want to update your recipient details if you have actually had any kind of substantial life adjustments, such as a marriage, birth or divorce. Life insurance coverage can occasionally feel complex.

No, level term life insurance policy does not have money worth. Some life insurance plans have a financial investment attribute that allows you to construct money worth in time. A portion of your costs payments is alloted and can make interest over time, which expands tax-deferred during the life of your protection.

You have some alternatives if you still desire some life insurance policy coverage. You can: If you're 65 and your insurance coverage has run out, for instance, you might desire to get a brand-new 10-year level term life insurance plan.

Sought-After A Term Life Insurance Policy Matures

You may be able to transform your term protection right into an entire life policy that will last for the remainder of your life. Lots of types of level term policies are convertible. That indicates, at the end of your insurance coverage, you can convert some or all of your policy to entire life protection.

Level term life insurance policy is a plan that lasts a set term usually in between 10 and 30 years and includes a degree survivor benefit and degree premiums that stay the same for the entire time the plan is in effect. This implies you'll recognize exactly just how much your repayments are and when you'll have to make them, permitting you to spending plan appropriately.

Level term can be a terrific option if you're seeking to acquire life insurance policy coverage for the very first time. According to LIMRA's 2023 Insurance policy Barometer Study, 30% of all adults in the U.S. need life insurance coverage and do not have any kind of kind of policy. Degree term life is predictable and affordable, that makes it among the most popular types of life insurance policy.

Latest Posts

Funeral Insurance Reviews

Funeral Plan Calculator

Burial Insurance Cost For Seniors